Audience Analysis: How to Match the Right Location with the Right People?

The Expansion Trap: Why Population Alone Isn’t enough?

In the race to scale up, many business owners and executives fall into the same trap, assuming that a higher population automatically means higher demand. On paper, it makes sense: more people, more potential customers. But in reality, this simplistic view often leads to disappointing results.

Under pressure to grow fast and outpace competitors, businesses sometimes cut corners. The quickest shortcut? Relying on population density as the main indicator for expansion. But densely populated areas don’t always equate to healthy sales or a loyal customer base. In fact, this approach can backfire. You might enter a crowded, oversaturated market, miss your actual audience entirely, or worse, set up shop in a place that’s simply not a fit for your offering.

Smart business expansion hinges on strategic location decisions, and the core of that strategy is audience analysis. Knowing how many people live in an area is no longer enough. You need to know who they are, how they live, what they earn, and where they spend their money. That’s where QI (Quant Intelligence) steps in to bring clarity, insight, and data-backed confidence to your expansion plans.

Understanding True Market Demand

Two locations can appear identical on paper. Both have the same population. But District A is composed of young citizens, and high-income households. District B, by contrast, consists largely of retirees, and low income. The same population count entirely different demand profiles.

Why? Because real purchasing power doesn’t come from headcounts alone, it’s a direct measure of market potential. You need to dig deeper into data layers that reveal, age structures, income brackets, and cultural preferences.

Audience Analysis: The Foundation of Smarter Business Expansion

So, what exactly is audience analysis and why is it essential to making data-driven growth decisions?

At its core, audience analysis is a structured, data-informed process for identifying and understanding the characteristics, behaviours, and purchasing power of your most relevant customers. It’s not simply about locating people; it’s about discovering the right people the ones most aligned with your value proposition.

This approach goes far beyond generic market segmentation. It allows businesses to distinguish between a passive “general audience” and a high-potential core audience those most likely to engage, convert, and drive sustained growth.

Key Dimensions of Effective Audience Analysis

Effective audience analysis hinges on understanding key demographic and behavioural dimensions that define your core customers. These include income levels, where purchasing power directly indicates market potential and helps align pricing with preferences; household size and composition, which shape spending behaviour and product preferences; and spending priorities, which reveal whether customers lean toward convenience, value, experience, or exclusivity. Together, these insights form a clearer picture of who your audience truly is and how to engage them effectively. This is where QI comes in.

Turning Data into Action: How QI (Quant intelligence) Uncovers the Right Locations

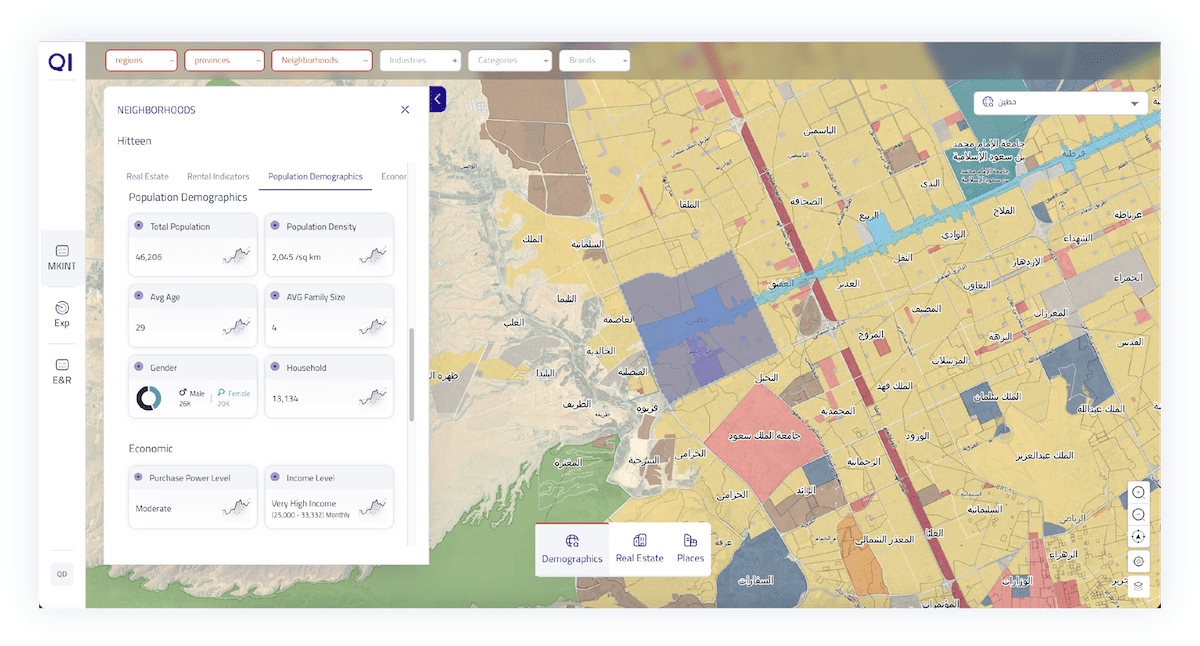

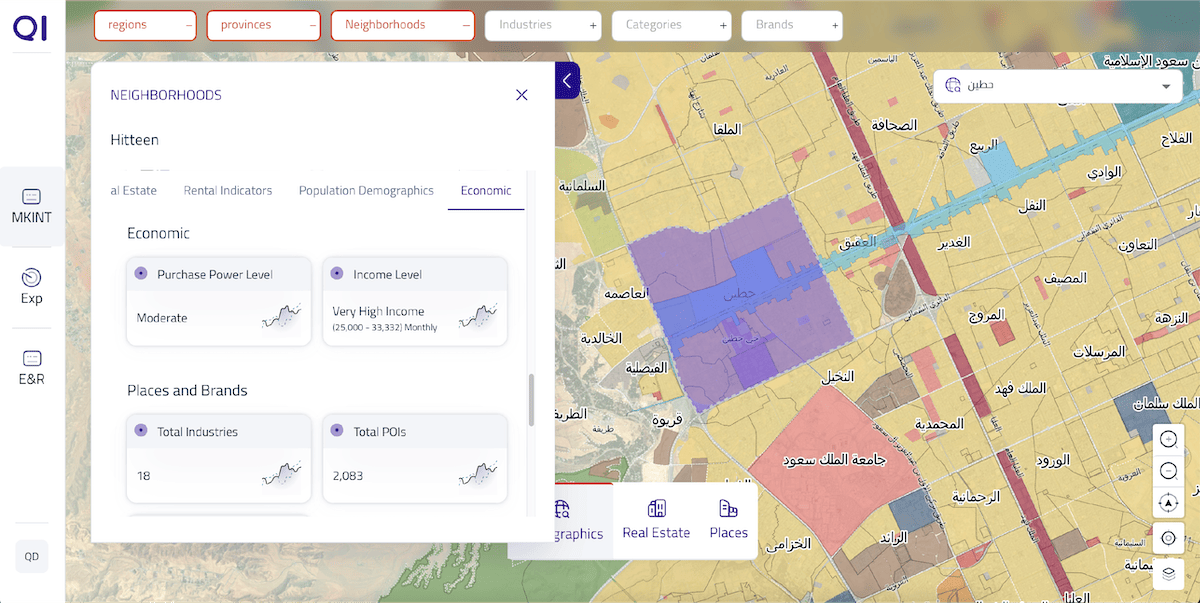

QI is an AI-powered location intelligence platform that goes beyond simple metrics like proximity or population counts. It translates complex demographic and economic data into actionable insights, aligning location strategy with business goals.

- Demographic Data Layer

QI provides a granular view of who lives in each area, capturing factors that shape demand:

- Population Density: Concentration of people signals potential demand, but real opportunity depends on who makes up that density young, aging, affluent, or low-income.

- Average Age: Different age groups drive diverse needs youth markets lean toward experience-driven services, while aging populations demand healthcare and stability.

- Households & Family Size: Family size influences demand for real estate, retail, groceries, and entertainment, guiding product sizing and service models.

By understanding these dynamics, businesses can tailor offerings and experiences to feel truly local and relevant.

- Economic Data Layer

QI also reveals what customers can afford and how they spend insights traditional tools often miss:

- Income Distribution: Match pricing strategies to the financial realities of each zone.

- Purchasing Power: Gauge true market potential by assessing discretionary income.

This helps businesses avoid surface-level “false positives” and instead target underserved areas with real growth opportunities and first-mover advantage.

5- Don’t Just Grow… Grow Where It Matters

Expanding your business isn’t just a numbers game it’s a people game. And in that game, knowledge is your greatest advantage.

It’s about understanding who your customers are, where they are, and how they live, move, and spend. In saturated or evolving markets, this level of clarity is no longer optional it’s a strategic imperative.

Audience analysis empowers you to focus on fit over footprint. It helps you uncover underserved pockets of demand, align your offerings with actual needs, and reduce the costly risks of poor location decisions. But audience analysis is only one side of the equation.

For businesses entering highly competitive or saturated markets, it must be complemented by a deep understanding of the competitive landscape. That was the focus of our pervious article. Read it here to learn more about effective competition analysis.

Reach out today and Let QI help you uncover the who, where, and why behind every location move.

Reach out to learn how QI helps you choose locations that give your brand a competitive advantage

Share this Article

![]()