Business expansion in saturated markets: How Competition analysis, and Demographic Data Drive Smarter Location Decisions

Unlocking Business Expansion with Data-Driven Competitor and Market Analysis

One common misconception is that competition should be avoided. Many assume that a crowded market offers no space for new entrants, and that saturated areas inevitably lead to slow growth and market failure. However, this belief often leads businesses to overlook potential opportunities. In reality, competition can be a strong signal of market potential, particularly when analyzed properly.

In this article, we explore why competitor analysis cannot be skipped when expanding in crowded markets and how data-driven platforms like QI (Quant Intelligence) are designed to help business extract actionable insights from competitor and market data. These tools don’t just show where competitors are they reveal where your brand can thrive can support smarter decision-making.

Why Competitor Analysis Is Essential for Business Expansion?

When expanding into a new market, competition isn’t just a threat it’s valuable insight. It tells you where demand exists, how others are meeting it, and where opportunities still remain. Instead of avoiding competitive areas, smart businesses use competitor analysis to guide their location and strategy decisions.

What Competition Tells You About Site Potential?

1. Market Validation: The presence of competitors indicates that others have already recognized commercial potential. Their existence often confirms that the area has a viable customer base, sufficient purchasing power, and relevant consumer demand. Rather than avoiding such markets, businesses can use them to validate their assumptions about location selection.

2. Gap Identification: Competitor analysis can uncover specific underserved customer segments or geographic zones. For example, a market might have plenty of premium service providers but few mid-range options. Recognizing these gaps can help businesses carve out unique positions that meet unmet needs.

3. Benchmarking and Learning: By studying competitors’ strengths, weaknesses, pricing strategies, service models, and customer engagement tactics, businesses can refine their own strategies. This learning process improves positioning and allows new entrants to avoid the common mistakes of their predecessors.

Competitor Analysis to Identify Market Saturation Risks and Expansion Barriers

1. Oversaturation: A high number of competitors in a small area can lead to diminishing returns. When too many similar businesses target the same customer base, it becomes difficult to maintain pricing power, brand visibility, and long-term profitability. A proper analysis helps assess the capacity of the local market and the potential cannibalization effects among similar offerings.

2. Dominant Players: Markets that are heavily influenced by entrenched brands with loyal customers can pose a significant barrier to entry. Without clear differentiation, new businesses may struggle to gain traction. Competitor analysis helps identify who the major players are, what makes them successful, and how to position yourself differently.

3. Lack of Differentiation: Businesses that launch without a distinct value proposition risk blending in. Competitor analysis clarifies whether your business model offers anything new or superior and if not, what changes are needed. Also, it provides insights into how others are positioned and allows new entrants to sharpen their brand identity, messaging, and service delivery before launch.

4. No Competiton at all: While the absence of competition might initially seem promising, it’s often a warning sign rather than a green light. No competitors could mean there is no proven demand, poor customer density, or unsuitable economic conditions in the area. Investing in such a market can be money-consuming, especially when you’re forced to spend heavily on customer education, awareness campaigns, and demand generation from the ground up. In many cases, businesses underestimate how expensive and time-consuming it is to build a market that doesn’t yet exist. Competitor analysis helps determine whether you’re entering a first-mover opportunity or simply walking into a low-potential zone that others have deliberately avoided.

The Limitations of Traditional Competitor Research in Modern Market Expansion

Why Outdated Methods Don’t Work in High-Saturation Markets

Many businesses today still rely on what seem like practical and familiar methods for competitor analysis searching on Google, asking industry peers or local business owners, or physically visiting potential locations to observe foot traffic and customer behavior. These approaches can offer surface-level insights and help form an initial impression. However, they are often limited in depth, slow to execute, and lack the precision required for confident decision-making.

Blind Spots in Site Selection Without Competitor and Demographic Layers

The problem with these methods is not that they’re obsolete, but that they’re incomplete. Google searches may show visible competitors, but miss smaller or newly opened ones. Conversations with business leaders are valuable but subjective and shaped by individual experience. Observing a location in person may help understand traffic patterns, but tells little about demographics, purchasing power, or long-term market trends.

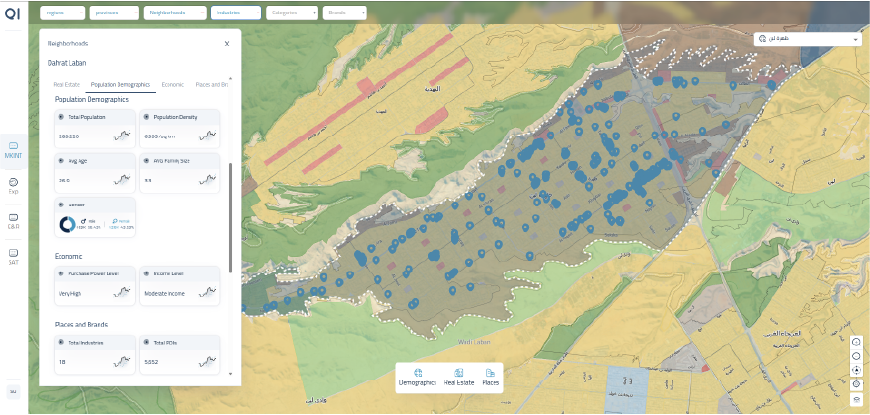

Using QI to Power Business Expansion Through Competitor, and Demographic Data Layers

QI is a location intelligence platform that helps businesses assess expansion potential using multiple layers of real-time market and competitor data. Rather than relying on fragmented reports or assumptions, QI provides a structured, comprehensive view of the operating environment.

Places and Competitors Layer: Understand Brand Distribution and Market Saturation

This layer provides a detailed view of existing businesses in a given area, categorized by name, type, and concentration. Whether you’re exploring new markets or evaluating specific neighborhoods, QI helps you identify areas with high business activity as well as those with limited service presence. By visualizing the distribution of business categories and density levels, it allows you to spot competitive clusters, dominant players, and untapped opportunities where demand may exceed current supply.

Population and Demographic Layer: Align Site Selection with Target Customer Profiles

This data layer in QI provides detailed insights into who lives and works in a given area, including breakdowns by age, income level, and occupation. This data is sourced from official authorities such as the General Authority for Statistics, national census records, labor force surveys, and telecom-based mobility data ensuring accuracy and relevance at the neighborhood level. For business owners, this layer is essential to align site selection with target customer profiles, tailor offerings to local demand, and avoid costly mismatches between the business model and community characteristics. Whether you’re launching a new location, evaluating franchise potential, or planning product localization, QI helps you make smarter decisions grounded in real demographic intelligence.

How to Know If a Market Area is Right for Expansion: A Practical Guide

Making a smart location decision requires understanding the balance between population density, competition intensity, and unmet demand. Not all areas with competition are bad and not all areas without it are good. QI helps decode this by enabling ratio-based analysis between population size, income and the number of active competitors.

Let’s break down three common scenarios that QI helps evaluate:

Scenario 1:

Take, for instance, a neighbourhood with 100,000 residents and only four competitors. On paper, this might signal low competition and high demand potential. But QI allows you to go further. By mapping the distribution of existing businesses and comparing them with income levels and age demographics, QI helps confirm whether the market is underserved or if the few competitors already dominate specific segments. It also identifies whether there’s a mismatch between the local population and the pricing or service model of existing players helping you validate if there’s room for your specific offering to thrive.

Scenario 2:

Now consider a similar area with the same population but ten existing competitors. This scenario might suggest saturation, but QI reveals nuance. With its Places and Competitors Layer, you can see if those competitors are tightly clustered in one sub-zone, leaving other high-footfall or residential areas underserved. You can also analyse brand coverage overlap to determine if there’s space for differentiation whether in pricing, experience, or positioning. By layering demographic data, QI helps you align your offer with local demand more precisely, identifying untapped sub-segments like young professionals or mid-income families that may be overlooked by existing providers.

Scenario 3:

Then there’s the case of a neighbourhood with 100,000 people and no competitors. While this could initially seem like a greenfield opportunity, it’s often a red flag. QI helps you investigate deeper are population densities too low in key pockets? Does the income profile support your price point? Are there signs of weak commercial activity overall? By visualizing these data points together, QI helps distinguish between a promising first-mover market and a high-risk zone with little spending power or demand. It also shows if similar businesses are present nearby but avoiding this area potentially revealing why.

While there’s no single formula for success, QI enables a layered approach to site evaluation. It helps you go beyond rough ratios and surface-level checks and instead see the full picture: who lives there, what they need, who’s serving them, and where unmet demand still exists. In a competitive landscape, this kind of insight isn’t just helpful it’s essential.

Smarter Site Selection Requires Multi-Layered Competitor and Demographic Analysis

Expanding in crowded markets demands more than just familiar methods. It requires a calculated approach built on solid data and sharp insights.

Competitor analysis is no longer a one-time task it’s a continuous process that guides everything from location and pricing to positioning and operations. Skipping it raises the risk of missteps in markets where margins are tight and competition is fierce.

With platforms like QI, businesses can uncover patterns, anticipate changes, and make smarter location decisions based not just on who’s already there, but on what’s missing and where demand is heading.

For a deeper dive into location intelligence, check out our previous article: Smart Site Selection Using Market Data, where we explore traffic, real estate, and flow data for business expansion.

Share this Article

![]()